America’s Reckless Tariffs Have Unintentionally Boosted Chinese E-Commerce Apps

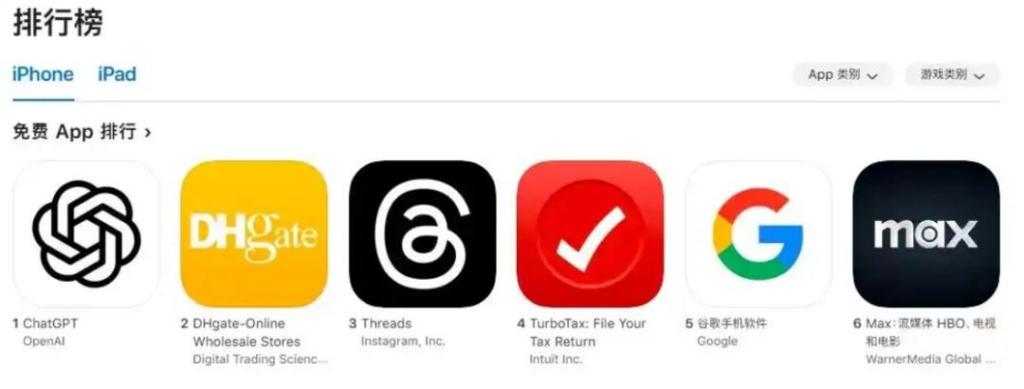

No one saw this coming. After the U.S. imposed excessive tariffs, Chinese cross-border e-commerce app DHgate (Dunhuang) unexpectedly went viral stateside. Its downloads skyrocketed to #2 on the U.S. App Store’s free apps chart, trailing only ChatGPT in popularity.

What Exactly Is DHgate?

Public records show DHgate was founded in 2004 as one of China’s first B2B cross-border e-commerce platforms. Between 2005-2014, it completed five funding rounds totaling over 550 million yuan, with participation from prominent investors like China Growth Capital, KPCB China, and JAFCO Asia.

Unlike Amazon or TEMU which focus on B2C sales, DHgate specializes in “chain-to-chain” and “small-scale B2B” transactions. After years of development, it has become the largest Chinese B2B cross-border platform in the U.S. market, attracting global users with its integrated operations spanning logistics and financial services.

Key metrics:

- 2.6+ million registered suppliers

- 77 million active buyers

- 33 million listed products

- Service coverage across 225 countries/regions

On April 12, DHgate saw explosive growth with 35,400 global downloads (56% above 30-day average), including 17,300 U.S. downloads (98% surge). By April 13, iOS downloads hit 117,500 (732% increase), with U.S. users contributing 65,100 downloads (940% spike). This makes DHgate the third Chinese app after TikTok and Xiaohongshu to achieve widespread U.S. adoption.

Why the Sudden Popularity?

The catalyst lies beyond DHgate’s services. After the U.S. announced 145% tariffs on Chinese imports, Chinese manufacturers took to TikTok to expose luxury brands’ pricing schemes. Videos showcasing production lines revealed how “Made in Europe” luxury goods—from watches to yoga pants—often originate from Chinese factories, including those producing for Nike and Lululemon.

Viral hashtags like #HowWeBypassTariffs and #ChinaExposedTheTruth highlighted stark price disparities. For example, one creator (@LunaSourcingChina) filmed outside a high-end brand’s factory, noting $100+ yoga pants cost just $5-6 to produce. This transparency drove Americans to DHgate for factory-direct pricing, circumventing traditional retail markups.

The Bigger Implications

DHgate’s rise reflects two awakenings:

- Chinese products carry massive markups after middlemen markups—even with tariffs, factory prices undercut U.S. retail.

- “Made in China” no longer means “cheap/low-quality”—many luxury items are manufactured there with equal craftsmanship.

This shift transcends bargain hunting, representing consumer backlash against brand inflation. As awareness spreads, more Chinese e-commerce apps like Taobao are gaining traction globally, disrupting traditional retail models.

For consumers, DHgate offers escape from “luxury traps.” For Chinese manufacturers, it signals new cross-border opportunities—the global demand for cost-performance isn’t uniquely American, but universal.